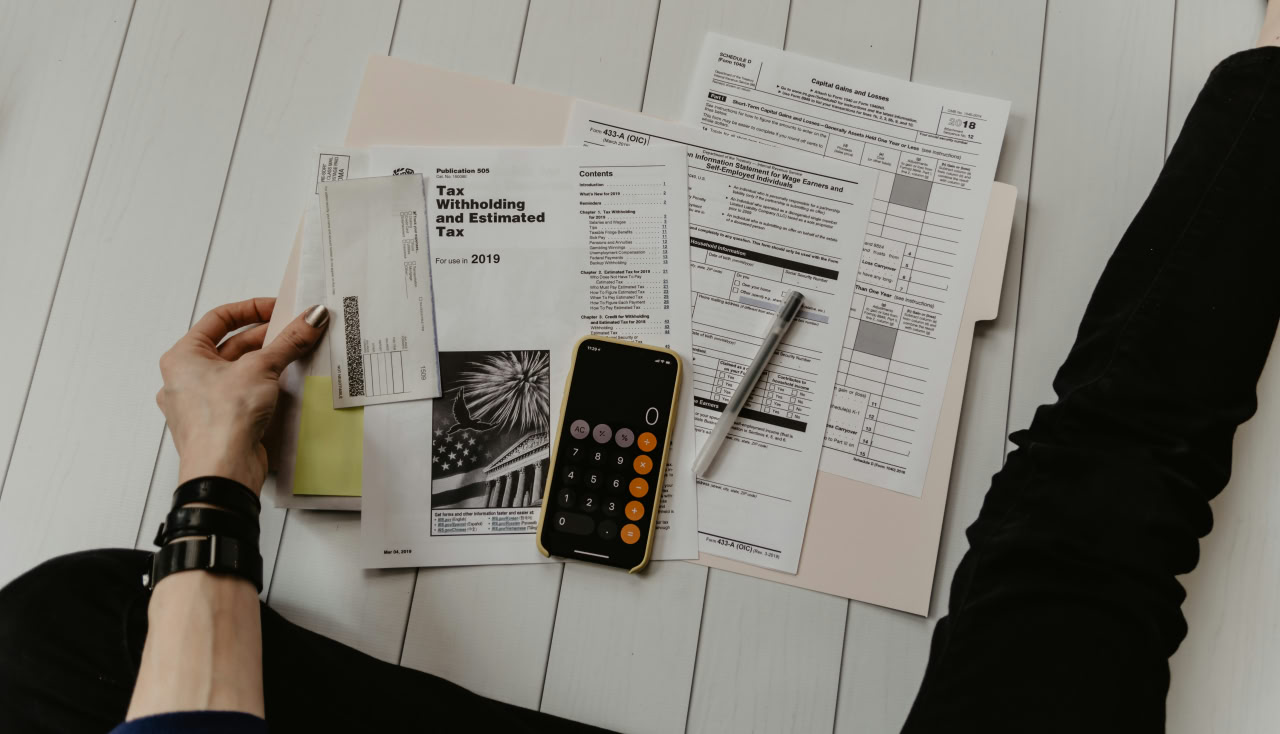

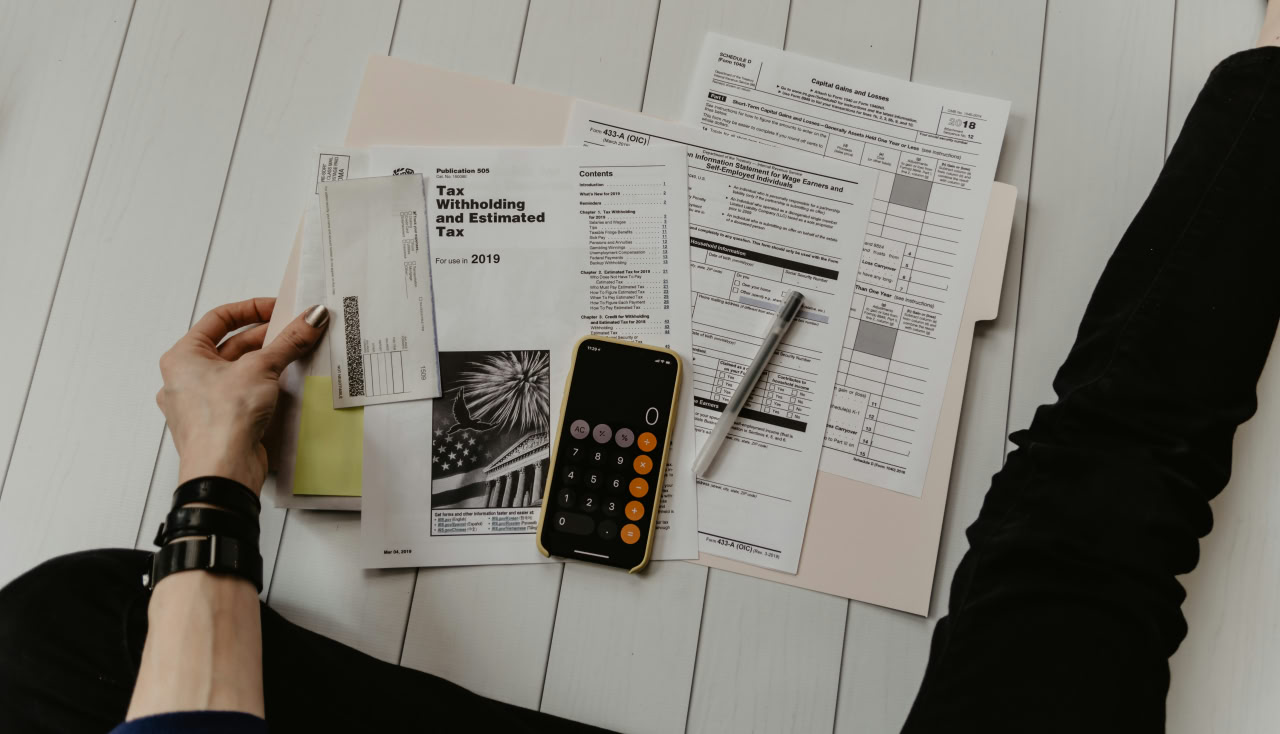

Self-Assessment Tax Returns

Comprehensive tax return preparation for individuals and businesses, ensuring compliance and maximizing deductions.

Key Benefits

Accurate and timely submission of your tax return

Identification of all applicable tax deductions and reliefs

Advice on tax planning strategies to minimize future tax liabilities

Support with HMRC correspondence and inquiries

Year-round tax advice and support

Our Process

1

Initial consultation to understand your financial situation

2

Collection and organization of all necessary financial documents

3

Preparation and review of your tax return

4

Submission to HMRC and confirmation of receipt

5

Advice on tax payment deadlines and amounts due

Ready to Get Started?

Contact us today to discuss how our Self-Assessment Tax Returns service can benefit you or your business.